2024 Economic Outlook from The Watch

Posted By : Armada Corporate Intelligence | Date : January 12, 2024The Watch report is updated monthly, and the latest information that we have available shows some interesting differences between national forecasts on economic growth for 2024 and what the models are showing us. First, most national forecasts are still showing the first and second quarters being slower with a mild (soft landing) recession possible in the first half of the year.

The chart below shows the outlook for quarterly Real GDP with a full annual forecast of approximately 0.8% growth for 2024 and a return to historical long-term growth rate just under 2% resuming in 2025.

For 2023, much of the economy was being propped up by three legs of a growth stool. Consumer spending accounts for 70% of GDP and with job openings still running 8.6 million (against a normal balanced rate of 6 million); annual wage growth estimated at 4.1% vs. average inflation trending at 3.6% late in 2023; and a willingness to continue to use credit cards to make purchases, consumer spending continued to be strong throughout 2023. Whether that continues in 2024 is another question, and one that we will cover later.

The second leg of the stool was growth on the back of strong nonresidential construction spending. Direct spending in nonresidential construction was running 18.1% higher year-over-year on $1.1 trillion in spending.

And lastly, government spending (Federal, state, and local) was keeping many sectors of the economy propped up. And with additional defense spending and the additional spending being added from the Inflation Reduction Act (IRA), CHIPS Act, and Infrastructure Bill, government spending should remain stable in 2024 (for better or worse as US debt surges to record highs).

In the third quarter of last year, we got an additional shot in the arm via inventory building activity going into the peak retail season. That pushed Q3 Real GDP to nearly 4.9%. But we lost that momentum in Q4, and GDP at the time of writing was projected to come in at approximately 2%. This is still stronger than expected earlier in the year.

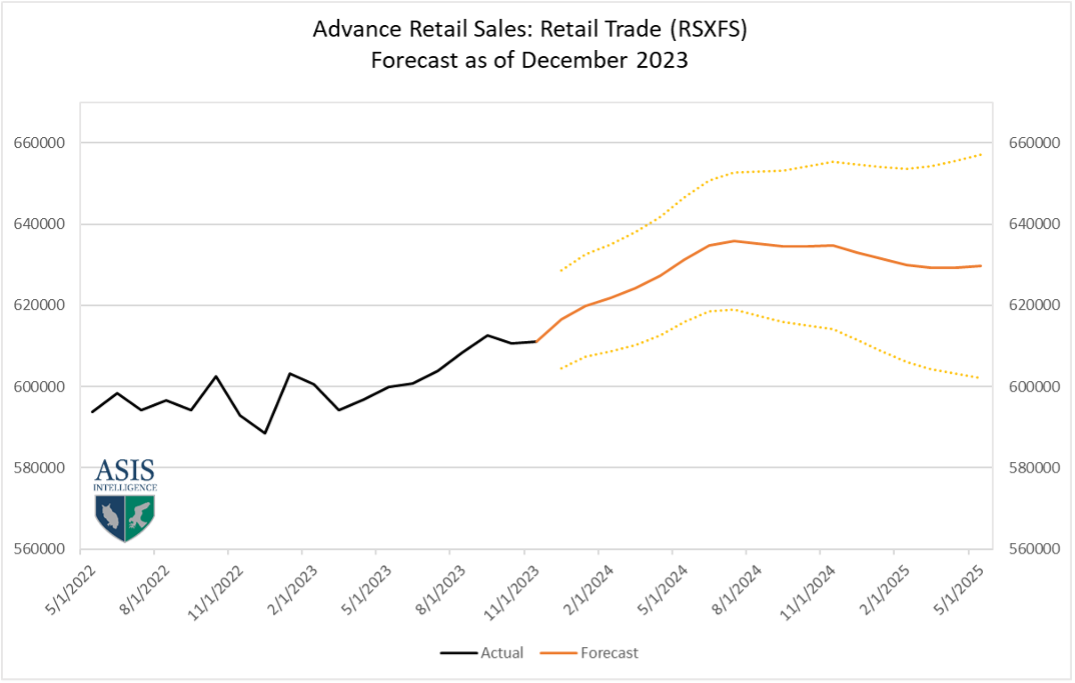

Our models from The Watch are picking up something a little different than the outlook from other macro sources (as mentioned earlier). We added a retail sales model to help predict the 70% of GDP accounted for by consumer spending. This also allows us to track changes in consumer spending on a monthly basis, whereas official and final consumer spending data is typically released on a quarterly basis.

We are giving you a sneak peek at the current model (through December) available to subscribers only from The Watch report. The current model shows spending remaining robust in the first half of the year and then it flattens and perhaps is going to face some slight downward bias well into 2025. The downturn in the model is almost light enough to push us into eliminating the risk of overall recession. This model would suggest that the recession risk is very low. Again, that can change.

Remember that this would account for only 70% of GDP, and a dip in other sectors would ultimately cause a drag on this data as well.

The longer-term graph shows that spending will remain near all-time highs (if it continues to show this trendline). If it remains true, this will show the broader US economy still performing well above the long-term trend and it would keep retailers hopping and would also push the global supply chain into a rebound phase.

Of course, conflicts can rapidly change the operating environment and there are questions about certain raw material availability under the weight of the global defense sector building munitions and equipment as fast as possible. The defense sector will get the nod for most of those materials first, and then commercial applications would follow. The Defense Authorization Act has already been invoked for certain aspects of the US supply chain to ensure that resources and certain materials remain stable, and supplies are available.

Again, the reason why The Watch is a monthly publication is that we update the models every month to adjust to changing market conditions. The advantageous facet of The Watch models is that we can incorporate scenarios into the models and show what it would do to the outlook.

For instance, with 18-22 metrics shaping and affecting each model, we can play with oil prices ranging from $45 a barrel to $145 a barrel and see what impact that would have. The advanced statistical approaches would adjust thousands of calculations to understand how a change in oil prices would affect the other 17-21 metrics and show us the output.

We will keep those scenario-playing / war-game playing options on the table for 2024 as conditions warrant – and include those in The Watch report for subscribers.

Armada has other models also included in The Watch covering predictions for automotive, aerospace, computers and electronics, machinery, electrical equipment and appliances, fabricated metals, and primary metals. We have also expanded the coverage to include the critical nonresidential construction sector. There are also new models covering truck tonnage, rail carloads and intermodal, and air cargo to give clients a broad view of their supply chain outlook. Interested parties can sign up for a free trial to The Watch (no credit card required) and the cost of subscription is inexpensive on a monthly basis (just $45 a month); and you can cancel at any time.